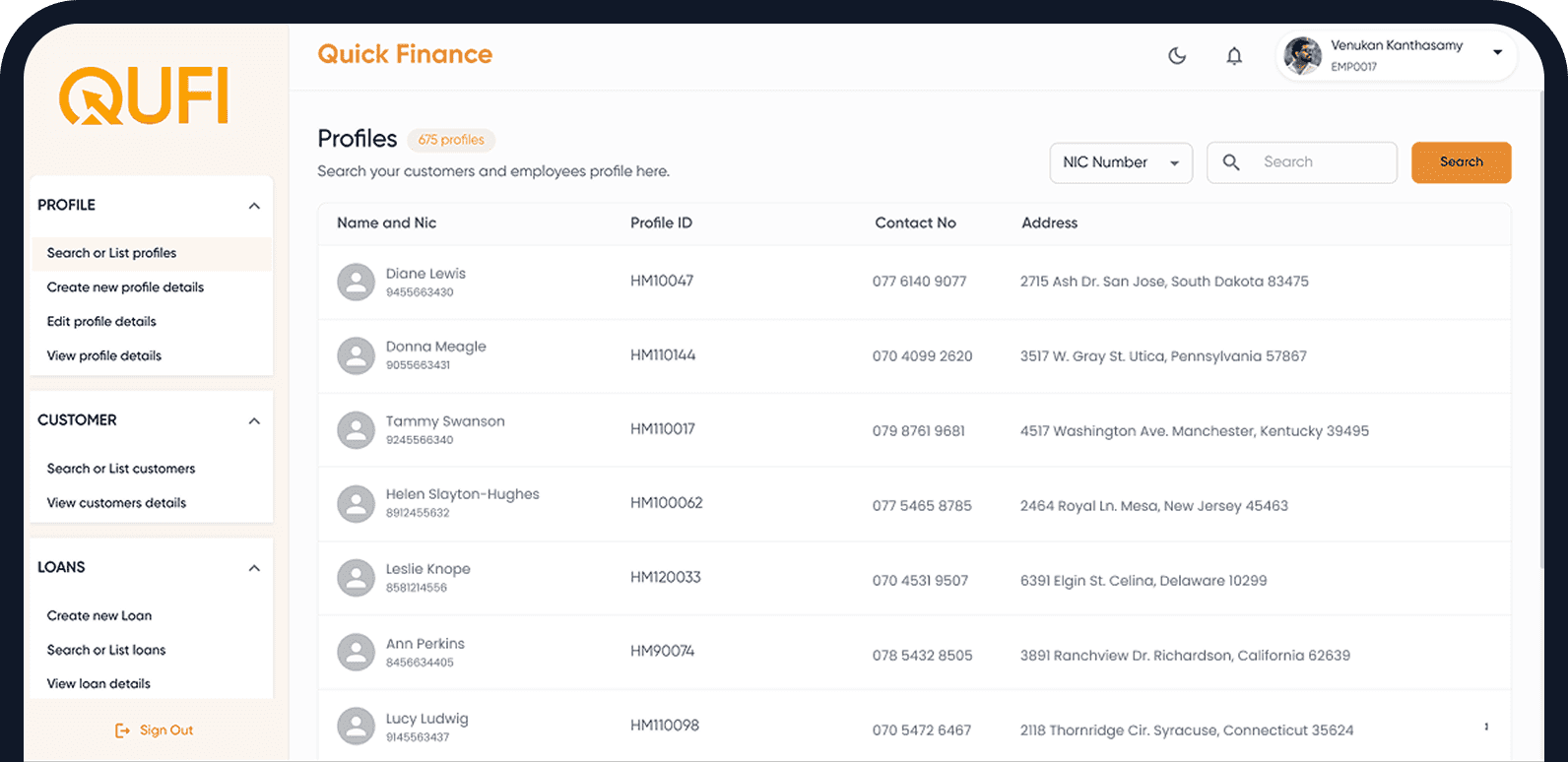

A modern platform to streamline lending, collections, and customer management.

Overview

Qufi is a microfinance company operating across multiple branches in Sri Lanka. Their manual processes - loan tracking, collections, ledgers, and customer inquiries-slowed down daily operations and limited their ability to scale efficiently.

The Challenges

Manual loan ledgers caused delays, errors, and inconsistent reporting

Customers could not access balances or payment schedules without calling or visiting a branch

Recovery officers needed a faster, mobile-friendly system to record collections on the go

Branch staff required a structured teller workflow to manage customer payments

Management lacked real-time insights into collections, arrears, and branch performance

Our Approach

We built Qufi as a lean but high-impact project, focusing on automation, clarity, and role-based workflows.

Requirement Mapping & Process Study

We studied Qufi’s existing manual workflows across all branches- including loan issuance, daily/weekly collections, arrears management, & ledger maintenance.

UI/UX & System Planning

We designed an interactive Figma prototype and refined it weekly with client feedback. The goal: simple screens, fast actions, and minimal typing for officers.

Full System Development

Backend architecture, Web portal development, Mobile features for recovery officers, Teller workflows for branch staff, SMS notification automation.

Testing & Onboarding

We tested the system in real-world conditions- poor network areas, busy collection hours, & parallel branch operations to ensure stability before launch.

Technology Stack

React

Laravel

MySQL Database

Cloud Hosting

Impact & Outcomes

Smarter Collections Workflow

Recovery officers mark payments instantly, reducing manual effort and improving accountability.

Real-Time Customer Access

Customers can check balances, due dates, and payment history without visiting branches.

Automated Ledger Updates

very collection - branch or field - is synced automatically, removing human errors.

Improved Operational Transparency

Managers get instant visibility into daily collections, arrears, and branch performance.